Obligations under Foreign Currency Regulation

Introduction

On 1st October 2024, Maldives Monetary Authority (MMA) published the Foreign Currency Regulation (Regulation No. 2024/R-91) which imposes various obligations on tourism sector taxpayers and banks.

The following is an overview of the obligations.

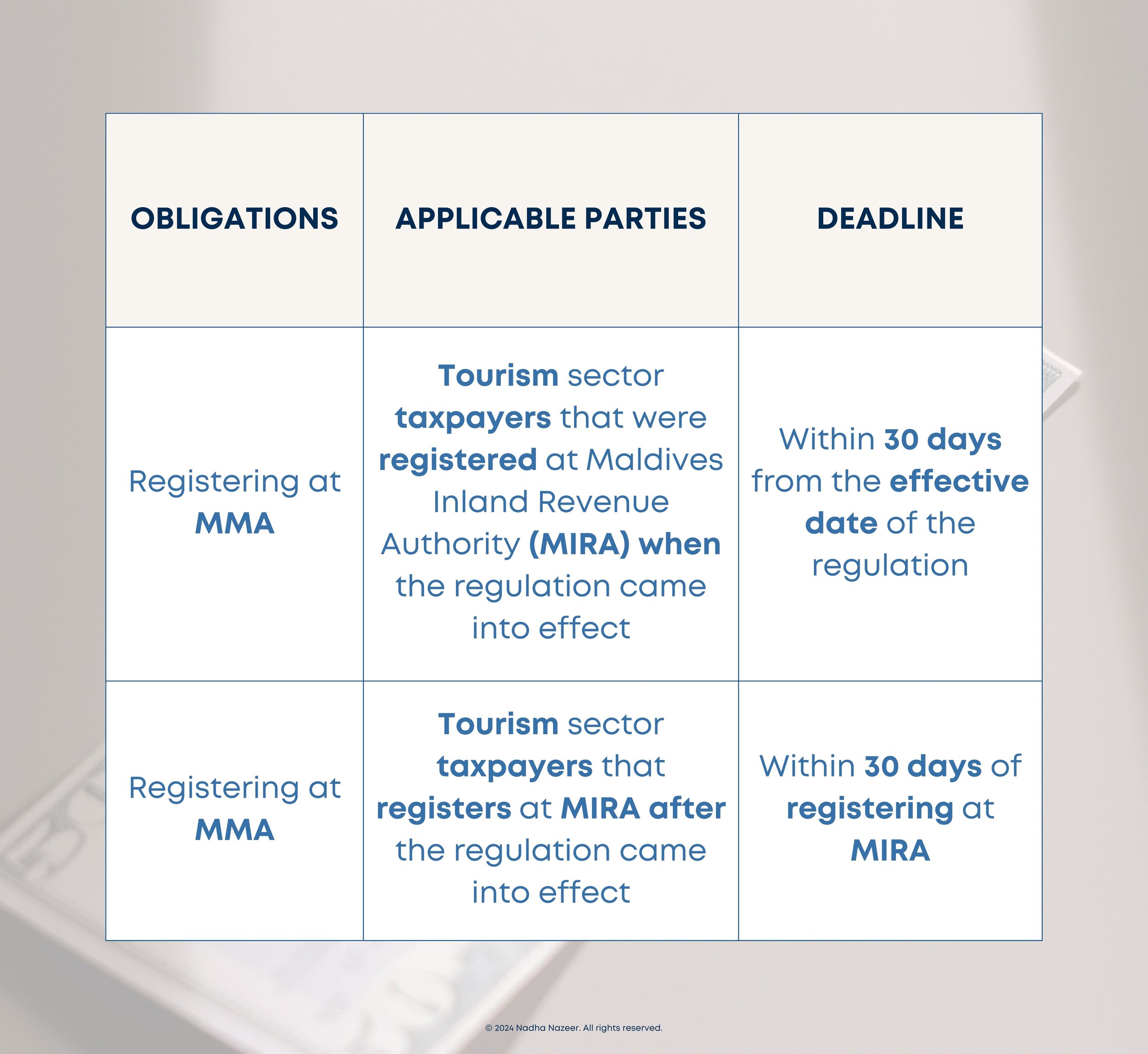

1. Registration

2. Reporting to MMA

3. Depositing Foreign Currency Income

4. Exchanging Foreign Currency

5. Recordkeeping

© 2024 Nadha Nazeer. All rights reserved.