Maldives Tax Newsletter – December 2024

Welcome to the Maldives Tax Newsletter where you will find highlights from national developments in tax law and policy.

Tax news

Major Changes to Tax Rates

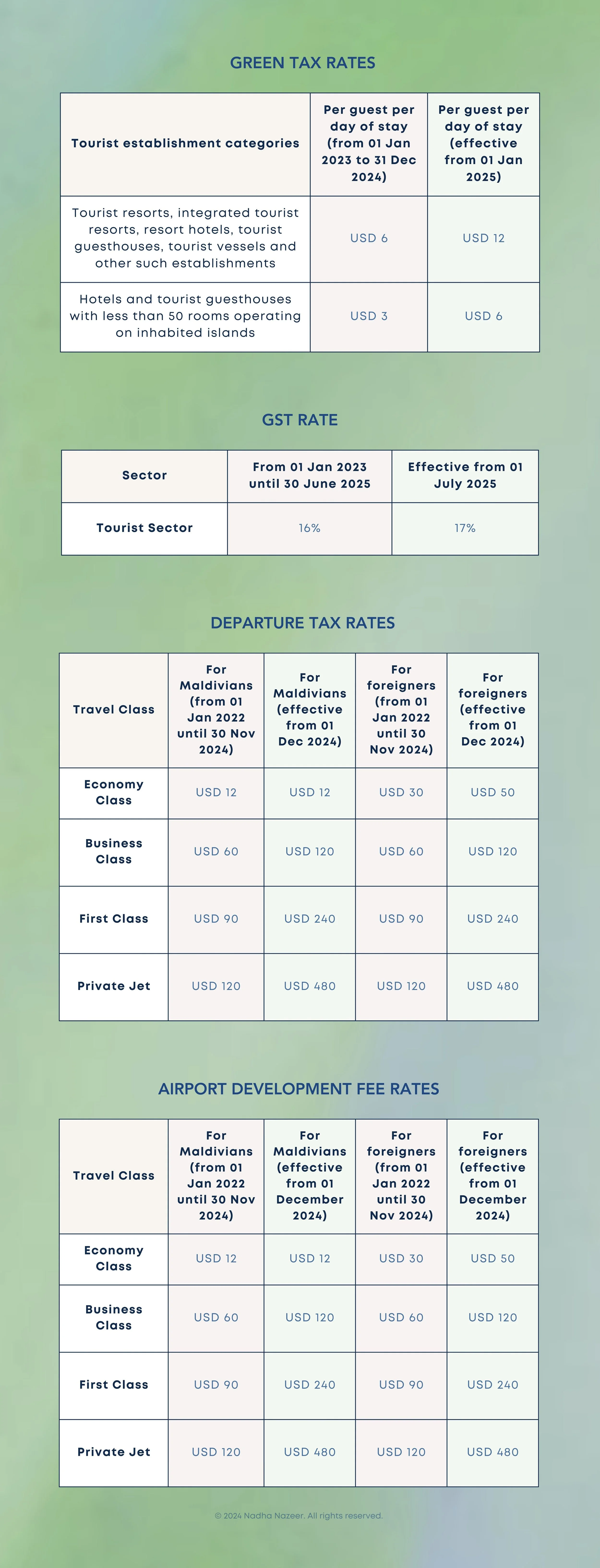

On 05 November, the President ratified the following amendments which revised the rates for green tax, tourism sector goods and services tax, departure tax and airport development fee:

Fourteenth Amendment to the Maldives Tourism Act

Seventh Amendment to the Goods and Services Act

Second Amendment to the Airport Taxes and Fees Act

Maldives Inland Revenue Authority (MIRA) Amends Regulations

In November, MIRA published amendments to the following regulations, reflective of the changes brought to the parent acts of these regulations:

Third Amendment to the Green Tax Regulation

Thirty-First Amendment to the Goods and Services Tax Regulation

Second Amendment to the Airport Taxes and Fees Regulation

Tax Appeal Tribunal Amends Regulations

On 20 November, Tax Appeal Tribunal published its Second Amendment to the Tax Appeal Tribunal Regulation 2021. The following are highlights from the amendment:

Introduction of a more detailed procedure for applying for a search and seizure warrant to enter premises not registered, as an address of the suspect, at MIRA.

Duration for submitting statements has been extended from 5 days to 10 days.

Tax Appeal Tribunal will hold open hearings and publish recordings of remote hearings.

Tax Highlights from the National Budget 2025

On 12 November, Ministry of Finance and Planning published the Budget Position Report 2025. It highlights the following:

Revenue policy changes for 2025 include introducing the destination principle and the establishment of a system to tax offshore travel agents and booking platforms.

Maintaining tax buoyancy in 2025 and 2026 requires improving tax compliance and reducing tax expenditure.

Tax revenue is projected to increase by 13.8% in 2025 compared to 2024.

As tax non-compliance is a revenue risk, enforcement actions against non-compliant taxpayers will be reviewed and amendments to the Tax Administration Act will be made to facilitate an increase in tax compliance.

People’s Majilis Passes National Budget 2025

On 27 November, the People’s Majilis passed a budget of MVR 56.6 billion for the year 2025 with a projected tax revenue of MVR 29.2 billion.

Tax cases

MIRA v Ecocare Turmine and Pest [1364/Cv-C/2022]

On 06 November, Civil Court passed its judgement in MIRA v Ecocare Turmine and Pest where it was held that the director of the defendant company was responsible for the company’s tax debt as he had agreed to be personally held liable for it.

Bunny Holdings (B.V.I) Limited v MIRA [2023/SC-A/03]

On 04 November, the Supreme Court passed its judgement in Bunny Holdings (B.V.I) Limited v MIRA where the court held, inter alia, that the strata lease transactions carried out under the Grant of Rights Regulation fall within the scope of Section 3(b)(1) of the Goods and Services Act (GST Act) and is thereby exempt from being subject to GST. Section 3(b)(1) of the GST Act states that a right or interest under a law or a contract does not constitute a “good” for the purposes of the GST Act. This marks the first time that the Supreme Court has ruled on this issue.

Conclusion

Thank you for reading our last edition of 2024. We hope you found the updates valuable. If you have any questions or would like any further information, please do not hesitate to contact us.

Subscribe to our newsletter to receive tax updates from the Maldives in your inbox every month.

Wishing you a very happy New Year 2025.

© 2024 Nadha Nazeer. All rights reserved.